13th June 2024, New Delhi

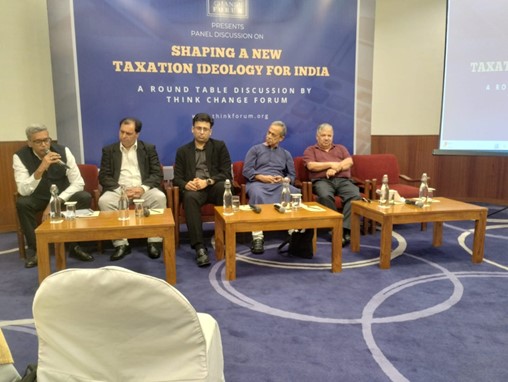

A distinguished panel at the event:

- Sudhir Kapadia, Sr. Partner, EY India. Mr. Kaushik Dutta, Co-Founding Director, Thought Arbitrage Research Institute gave a perspective on Indirect Taxes during the event.

- Manoj Pant, Ex Director, Indian Institute of Foreign Trade & Expert in International Trade

He is an expert in international trade and related fields. His impeccable knowledge about international trade has earned him respect and admiration in the international trade sector.

- Rajat Mohan, Executive Director – GST, MOORE Singhi

He is an expert in taxation particularly GST, he is well respected as a taxation professional. He has been a taxation advisor to many prestigious institutions and companies in his illustrious career.

- Pulin B Nayak, Centre for Development Economics, Delhi School of Economics. He is a well-known economist, with an impeccable track- record of excellence in the field of economics. He has been an economic advisor to many prestigious institutions and companies in his illustrious career.

- Yogendra Kapoor, Chartered Accountant and a renowned economy, business & tax commentator. He is a well-known Chartered Accountant with incisive knowledge about business, finance and taxation. His financial expertise is well respected in the financial and business circles.

Think Change Forum organized an event with a panel of eminent luminaries from different sectors. The panel discussed the Indian Taxation System. The panel believed that India could reduce taxes, maintain a low tax to GDP ratio and still collect robust taxes because of its large population. The panel emphasized that the informal economy needs to become part of the tax net to enable the transition from being a large economy to a developed economy. The panel at the event suggested 5 Key Bold Reforms needed to support the shift from rates to revenue. The experts stressed on the need for a shift in the taxation mindset from rates to revenue for India to become a developed economy. The panelist emphasized on the need for a new taxation ideology to make the transition from rates to revenue focused on lowering tax rates, enlarging the tax paying base and thereby creating the means for financing of India’s development related requirements. One of the important panelist Mr Sudhir Kapadia, Sr. Partner, EY India, said, conventional higher tax rates haven’t resulted in significant tax buoyancy. He observed that the governments in India since 1991 onwards have clearly been in favour of moderate tax rates leading to greater levels of transparency and compliance. Panelist observed that there could be one simplified rate structure for businesses and for individuals, there could be one simple three rate structure with low / moderate rates, no surcharges and cesses and no significant deductions. Sudhir Kapadia observed that there has been a steady increase in income tax revenues, but we need to have continued focus on taxpayer experience with tax administration and ensuring that the filing process remains seamless and hassle-free. The panelist at the event observed that a wider tax base will lead to more revenue collection. The panelist further said that under GST, taxpayers increased from 60 lakh in 2017 to 1.40 crore in 2023 with over 114 crore returns reported to be filed till June 2023. This depicts that a wider tax base leads to more collection. The event suggested 5 bold reforms to accelerate India’s financial position and strengthen taxation under the new taxation ideology of reducing taxes and enhancing the base. The panel suggested pro-growth and investment policies for higher income and consumption – The panel was of the view that such policies involve initiatives to stimulate investment, encourage entrepreneurship and promote innovation across various sectors of the economy. The panelist at the event observed that GST has broadened base and removed the cascading impact of taxes. GST has streamlined the law and reduced slabs to simplify compliance, it has also reduced administrative burdens while promoting compliance at every level.

The panel had strong views on unclogging the cases as over 5 Lakh Cases amounting to INR 14.2 trillion as of March 31, 2022, under CIT(Appeals). The panel suggested low corporate tax rates devoid of surcharges and cesses as such measures not only promote tax efficiency but also provide businesses with greater clarity and certainty regarding their tax liabilities. The panel believed that Tech-enabled and smart tax administration for effective enforcement is the answer along with improvement in taxpayer services. The panel concluded the event by saying that whether it is taxation or other reforms, we must all work towards one single goal of making India a developed country by 2047.